Online accounting software has made life easier for thousands of business owners around the world. Able to be there when you need it, it makes things quicker and easier, preparing you for life in the digital era.

But with dozens of options out there to choose from, picking the one which is right for you could seem a huge task in itself. As it’s likely you’ll be using the same software for years to come, it’s important to get it right from the very start.

Our Accountants use Xero in combination with Receipt Bank – all of our customers benefit from a free subscription to both pieces of software to make online accounting a simple and enjoyable experience.

This is our pick of the best available, to make your choice easier and get you on the right path. Most importantly, all are Making Tax Digital (MTD) compliant, so you are ready for the deadline when it arrives.

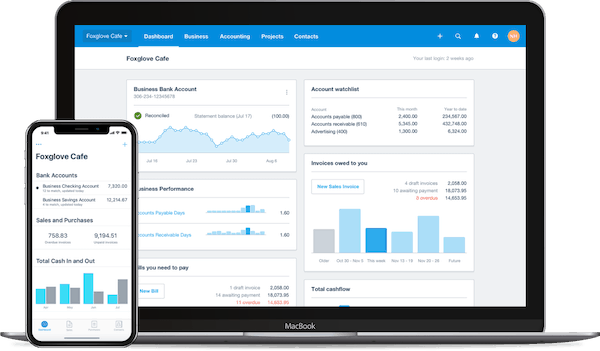

Xero

A web-based cloud application designed with small and growing businesses in mind, Xero makes it incredibly easy for owners and directors to be connected to their advisors and stay up-to-date with the financial side of things.

Because it is web-based, you can access it from anywhere. There is an app for any on-the-go additions, such as that lunch you have just bought a client you’d otherwise forget to account for. The online software makes things clear and concise if you’d prefer to spend an evening every week adding all the expenses.

Cash flow, transactions and account statements are there for you to check at any time, with real-time statistics. You can see when bills are due so you can pay your vendors on time and maintain strong relationships, and there is also an invoice section so you can see any outstanding bills you are owed.

There are 700+ compatible apps which can you can integrate, from Shopify to PayPal and AutoEntry, and everything is MTD ready so you can be compliant with HMRC requirements with no fuss.

For any businesses with employees, Xero makes the payroll side of things much clearer. From choosing the date of payment to approving time off and seeing all of your tax obligations, what was once a very time-consuming and complicated task is now a breeze.

It is by far one of the best out there and makes organisation and updates clear and quick. All of the hassles of running a business is suddenly reduced, and you can spend those saved hours growing your business instead.

Quickbooks

See your allowable expenses, total income, outstanding invoices and payroll all in one place. Quickbooks breaks everything down on your behalf, auto-categorising your expenses and calculating the tax due, so you are ready for HMRC when the time comes. From telling you how much you spent on car mileage and advertising, to working out National Insurance/pension contributions and sending the real-time info to HMRC, it truly works for you so you can focus on running your business and enjoying some much-needed time away.

Because everything is worked out for you, it helps you stay compliant with all the rules and regulations, so you have nothing to worry about if checks need to be made. Adding your accountant to the records is easy, so they can make any updates and changes you have asked them to make or check through it all if things don’t quite look right.

There are three levels available, so whether you are a contractor who needs to keep on top of several jobs and submit a self-assessment return, or you run a retail empire and need to file a payroll/manage stock/work with several currencies, there is a plan made with you in mind.

Everything is MTD compliant, making the switch easy and ensuring you are ready for the change. The app also makes checking up on real-time data accessible from anywhere, for a full 24/7 management system.

Sage

The Sage Business Cloud is a trusted way to manage all things business related, from the accounting, banking and payments to employees and payroll solutions.

Whether you are a freelancer or a small, medium or large business, you can access the perfect level of support you need in every area which concerns your particular situation. There is basic accounting, payroll and payment ability which allows small business owners or sole traders to save time, know where their money is going and see where they stand at a glance. This can be increased for large businesses, with the addition of thorough finance data, sales and distribution data, staff management and even waste disposal information.

Sage has been working with HMRC on MTD for a few years now, so the software is fully optimised for both new and existing customers. Data will be there for when the end-of-year tax returns or quarterly VAT returns arrive, so there is no rush before deadlines.

Everything you submit is safe at bank security level, and an accountant can easily check up on everything if needed. Even though it offers a high level of support and integration for large industrial businesses, the plans available for small startups or freelancers are just as well thought-out and easy to navigate.

FreshBooks

Created for small businesses, this cloud-based software keeps things simple, up-to-date and secure so you can put your effort into the side of business ownership that you love.

It cuts down on the time you spend chasing unpaid invoices, creating and sending them on your behalf and giving clients the option to pay there and then on their credit card. All expenses can be accounted for, with the ability to photograph and file any receipts or proof of purchase documents and it will categorise them, so you know just how much you are spending on advertising, travel and supplies.

Reports are easy to understand, so you won’t have to obtain an accounting qualification to know what is going on and your accountant will be able to see your data without having to chase you up to explain what it all means. Thanks to the mobile app, you can stay connected to your accounts at all times, and view real-time information from anywhere as long as you have an internet connection.

There are plenty of other handy features too. The project collaboration section gives you one handy place for everyone to stay updated on timelines and what needs doing. If you have employees or contractors working on specific projects, or you are a freelancer yourself, the Time Track function lets everyone log their hours and what has been done, so you can invoice for what you’re worth or pay out for what you have received. Perfect for any businesses in the creative industries.

KashFlow

An all-in-one accounting software solution, KashFlow keeps everything simple for small businesses.

Every area of your finances can be logged, from the mileage and travel costs to the invoices you need to send to clients and the payroll salaries you need to part with. You will be able to ensure you are getting the benefits and allowance claims you are entitled to, and any money you owe or are owed can be viewed until you can tick it off the list.

VAT returns can be a big headache for any business, no matter the size, so KashFlow’s direct link to HMRC is very welcome. Not only can you see when it is due, how much is due and the period it applies to, but the click of a button will send all of that data straight to the people who need it. No more having to transfer all of the data over into another form, and no more rushing at the last minute to get it all ready – you are instead ready for the MTD deadline and integration.

You can set up recurring bills, direct debits and expenses if you make regular purchases from a particular supplier, and the mobile app also allows you to add everyday expenses ASAP. From coffees to equipment, every penny counts to your business, and you can categorise the costs, calculate the VAT and attach the receipts, so you’re ready to claim when the time comes, and you’ll get everything back which you are owed.

Payment collection is made quicker thanks to the integrated features which help you out. Bank and card payments can be made using the secure gateway, automatic prompts can be set up for any late invoices due, and face-to-face card payments can also be filed immediately with no need for you to register every single one at the end of the day.

ClearBooks

Able to submit MTD data returns direct to HMRC in line with upcoming legislation, ClearBooks also has a “jam-packed” list of key features to make running your business smooth and hassle-free.

There is the option to customise and sent invoices all from one place, which will help you to keep on top of outstanding client payments. A reminder feature will let you subtly chase up any outstanding or late bills, too.

Because clients don’t always work in the same way you do, they can pay in a variety of ways which you can approve, from PayPal transactions to Direct Debits. Multi-currency support is there, for any international orders.

The VAT system is simple to navigate, as all you do is choose a time period, select all of the invoices and transactions which apply and submit directly with the click of a button. It supports all of the major schemes, no matter which your business is signed up to, and any EU purchases or sales are also dealt with.

Bank statements can be imported to take the time out of manually uploading every entry, and you can match up transactions to make them easier to explain. Everything can be reconciled and checked against each other so that any discrepancies can be solved straight away.

Basic use is free for small business owners who just need invoice tracking, bill tracking and a bank transaction list (but this is not yet MTD ready), and more complicated plans are very well-priced for what you get and completely MTD compliant. Payroll options are available on a cost-per-employee basis. Accountants can be added to any accounts if you’d prefer to take this route, too.

QuickFile

Easy to use and featuring automated accounting for quick results, this is a good choice for any small businesses who want a free option to help them keep their outgoings low.

The free version is for any company or sole trader who has fewer than 1000 ledger entries (nominal transactions) created over the previous rolling 12 month period. You get clear invoices, online payment ability through Stripe/PayPal/WorldPay amongst others, expenses and receipt management, invoice creation and estimation, full currency support and customisable reports which can cover profit, loss and project management.

We think this is plenty for any startups or small retail environments who maybe only have a few transactions per day and will easily slot into the account size limit. There are adverts within the software, but this is what makes it free.

Don’t worry if you will be above this cut-off though, as a paid version is available which is still a great price. You can integrate with other cloud apps and software, see segmented profit and loss reports, and create a fully customisable experience and an invoice template.

All plans feature 1 GB file storage, year-end tools and two-factor authentication. You also have unlimited users, so if you’re in a partnership or want to work alongside an accountant you can. Additional file storage is available, but there is not currently a mobile app which could put some 24/7-style people off a bit.

All in all, for a free piece of kit, there are all the basics there, and the ability to move up to a more thorough service if your business grows above the limitations will give you peace of mind.